In the event of an emergency, liquidity is an important ingredient to allow a business to deal with that emergency. Deposits are the lifeblood of banks, and loans are the means to generating income for the bank. As with all financial ratios, the LDR is most effective when compared to banks of the same size, and similar makeup. Also, it’s important for investors to compare multiple financial metrics when comparing banks and making investment decisions. The LDR helps investors to assess the health of a bank’s balance sheet, but there are limitations to the ratio. The LDR does not measure the quality of the loans that a bank has issued.

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. In the same way that increases in reserves expand deposits, decreases in reserves will cause a contraction by the same amount.

Does my debt-to-income ratio impact my credit?

The current ratio includes all of a company’s current assets, including those that may not be as easily converted into cash, such as inventory, which can be a misleading representation of liquidity. You can calculate the current ratio by dividing a company’s total current assets by its total current liabilities. Again, current assets are resources that can quickly be converted into cash within a year or less. However, empirical studies reveal that only a sustained increase in disposable incomes and measures taken towards financial inclusion will go a long way in increasing bank deposits.

- The money is on-demand, which means that deposits must be returned to customers whenever they demand their money.

- This assumption applies a 0% ACF factor on the

stable portion of cash flows with cash flow maturity within year and 1 year or more. - Those who fancy that this tweaking can meaningfully boost SME financing would be very disappointed, if experience in other economies without such a regulatory cap is any guide.

- Since the foreign-currency loan/deposit ratio is over 100 percent for China’s banking sector, the change helps ease the constraint system-wide.

- Liquidity is a term used to indicate how easily a company can convert its assets into cash.

The bankers say that since the facility will end in mid-July, there will be more pressure on the CD ratio. The debt to equity ratio shows a company’s debt as a percentage of its shareholder’s equity. If the debt to equity ratio is less than 1.0, then the firm is generally less risky than firms whose debt to equity ratio is greater than 1.0.. Shareholder’s equity is the value of the company’s total assets less its total liabilities. If you have a $50,000 loan and $10,000 is due this year, the $10,000 is considered a current liability and the remaining $40,000 is considered a long-term liability or long-term debt.

Cd Ratio Calculator

While helpful both cyclically and structurally, the latest CBRC tweaking to the loan/deposit ratio is no more than a stopgap measure. Those who fancy that this tweaking can meaningfully boost SME financing would be very disappointed, if experience in other economies without such a regulatory cap is any guide. HKMA

RCF – Unencumbered loans to banks where the loan is secured against

non-Level 1 asset as defined in the LCR. HKMA

RCF – All central bank reserves, including, required reserves

and excess reserves. The LRRCHKMA application does not compute ACF items

such as Tier 1 and Tier 2 capital, deferred tax liabilities, and minority

interest. By updating the latest Basel Run Skey as a setup parameter, LRRCHKMA picks

up the respective standard accounting head balances and applies the respective

ACF factors.

The Federal Reserve has a treasure trove of data available on their website, under the data tab. In there, we can find data on the largest banks in the system and others below the big banks. So our two examples above, Bank of America and Ally, had a wide range of ratios, with Ally’s closer to the ideal ratio.

The Debt to Equity Ratio

The assumption applies an 85% RCF factor on unencumbered securities,

with a remaining maturity of more than 1 year and which do not

qualify as High quality liquid assets under the LCR Rule. Total loans are found in the asset section, while deposits are in the liabilities section. That might seem counter-intuitive, but loans are assets because they generate income in the form of interest income. At the same time, deposits cost the banks money because they have to pay interest to encourage those deposits. The money is on-demand, which means that deposits must be returned to customers whenever they demand their money. Also, the LDR helps to show how well a bank is attracting and retaining customers.

NRB flexible about fixing CD Ratio so as to increase lending capacity of BFIs – Myrepublica

NRB flexible about fixing CD Ratio so as to increase lending capacity of BFIs.

Posted: Thu, 26 Aug 2021 07:00:00 GMT [source]

If your business is a small business that is a sole proprietorship and you are the only owner, your investment in the business would be the shareholder’s equity. Out of 27 commercial banks, 15 Banks have base rates that are greater/equal to the average base rate. Sunrise Bank Leads the position by having the highest base rate of 10.11 followed by Mega Bank cd ratio formula and Civil Bank. Whereas, Ratriya Banijya Bank and Standard Chartered Bank have the lowest base rate notwithstanding the fact that it is still high as compared to the Q3 of last year. The percentage of increase in base rates of the said bank is 24.76% and 29.40% respectively. You’ll want to consider the current ratio if you’re investing in a company.

Tweaking China’s loan-deposit ratio rule

Other measures of liquidity and solvency that are similar to the current ratio might be more useful, depending on the situation. For instance, while the current ratio takes into account all of a company’s current assets and liabilities, it doesn’t account for customer and supplier credit terms, or operating cash flows. The RCF factors

applicable to unencumbered securities, with a remaining maturity

of more than 1 year and which do not qualify as High quality liquid

assets under the LCR Rule, are predefined as part of this assumption.

For example, a company’s current ratio may appear to be good, when in fact it has fallen over time, indicating a deteriorating financial condition. Companies with an improving current ratio may be undervalued and in the midst of a turnaround, making them potentially attractive investments. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Company Profile

The second measure is for the governments to increase the income of the people. Banks will be the direct beneficiaries of increase in disposable incomes of people. The application supports multiple pre-configured rules

and scenarios based on HKMA specified scenario parameters such as inflow

rates, outflow rates, run-offs, haircuts, and so on. HKMA

ACF – Borrowings and liabilities with residual maturities and

cash flows falling beyond 1 year. HKMA

ACF – Other funding from all customers, with residual maturity

of less than 1 year. Don’t let the lease term throw you off; they are not the same as the leases that Bank of America uses for office space, which is debt for the bank.

What is a normal CD?

A standard compact disc measures 4.7 inches, or 120 millimeters (mm), across, is 1.2 mm thick, weighs between 15 grams and 20 grams, and has a capacity of 80 minutes of audio, or 650 megabytes (MB) to 700 MB of data.

The available core funding is

then taken as a total of all the weighted amounts where an ACF factor

is applied. Investors can use the loan to deposit ratio as a quick measure of the banks’ liquidity. It also tells us how well the bank is attracting customers and retaining those customers. If the bank isn’t increasing its deposits or its deposits are shrinking, the bank will have less money to lend. In some cases, banks will borrow money to satisfy its loan demand in an attempt to boost interest income.

What is the ratio of AB to CD?

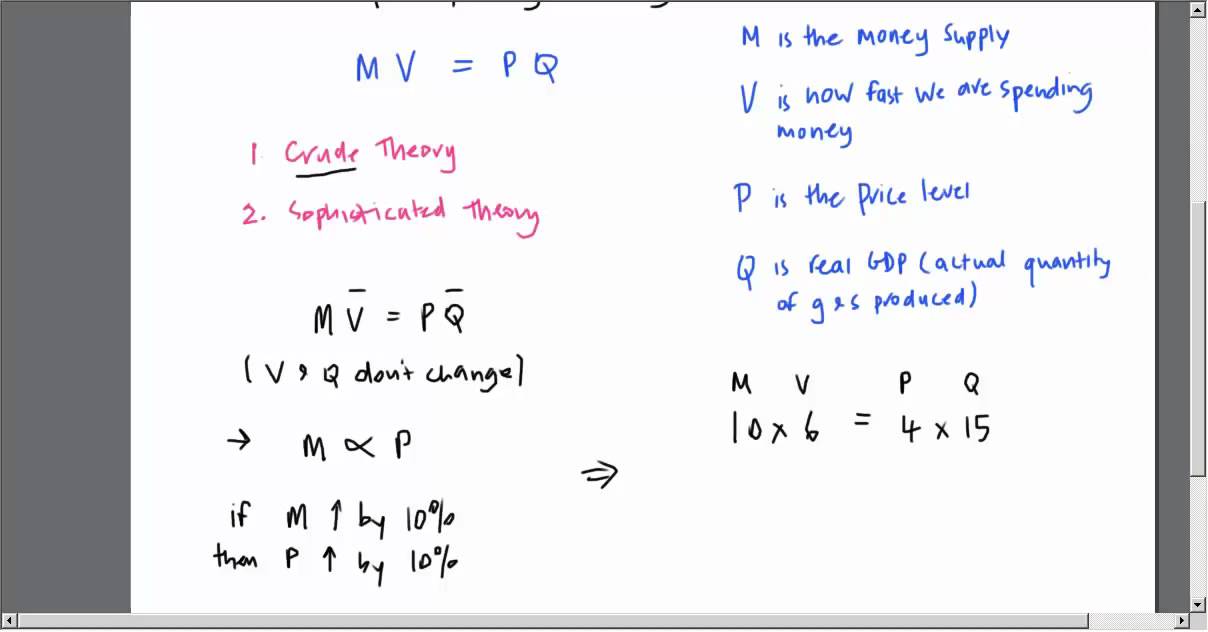

So the ratio between 𝐴𝐵 and 𝐶𝐷 in its simplest form would be three to two.