Return on equity, free cash flow (FCF) and price-to-earnings ratios are a few of the common methods used for gauging a company’s well-being and risk level for investors. One measure that doesn’t get enough attention, though, is operating leverage, which captures the relationship between a company’s fixed and variable costs. A high DOL reveals that the company’s fixed costs exceed its variable costs. It indicates that the company can boost its operating income by increasing its sales. In addition, the company must be able to maintain relatively high sales to cover all fixed costs. Operating Leverage is a financial ratio that measures the lift or drag on earnings that are brought about by changes in volume, which impacts fixed costs.

Operating leverage is the ability of the firm to use fixed operating costs to magnify the effects of changes in sales on its EBIT. A firm that operates with both high operating and financial leverage can be a risky investment. High operating leverage implies that a firm is making few sales but with high margins. This can pose significant risks if a firm incorrectly forecasts future sales. Running a business incurs a lot of costs, and not all these costs are variable.

Operating Leverage

However, in their model the firm always operates at full capacity, ignoring the important role of production flexibility and the relative effects of fixed versus variable costs. The management of ABC Corp. wants to determine the company’s current degree of operating leverage. The variable cost per unit is $12, while the total fixed costs are $100,000. The degree of operating leverage (DOL) is a financial ratio that measures the sensitivity of a company’s operating income to its sales.

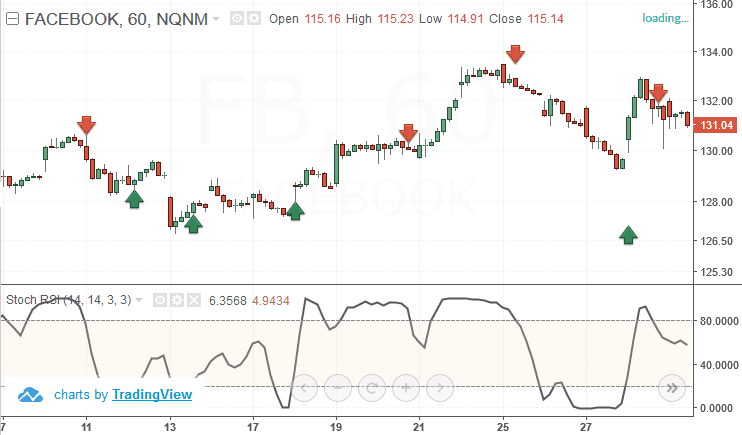

Looking back at a company’s income statements, investors can calculate changes in operating profit and sales. Investors can use the change in EBIT divided by the change in sales revenue to estimate what the value of DOL might be for different levels of sales. This allows investors to estimate profitability under a range of scenarios. This new factory would enable the automaker to increase car production and increase profits. Financial leverage is 1.1429, this means that 1% change in EBIT will cause 1.1429% change in EBT. This relationship between % change in EBIT and % change in sales is known as Degree of Operating leverage.

Break-Even Analysis and Operating Leverage

More sensitive operating leverage is considered riskier since it implies that current profit margins are less secure moving into the future. Companies with high operating leverage can make more money from each additional sale if they don’t have to increase costs to produce more sales. The minute business picks up, fixed assets such as property, plant and equipment (PP&E), as well as existing workers, can do a whole lot more without adding additional expenses.

- The Highly risky situation as it consists of large fixed costs.

- The degree of operating leverage (DOL) is a financial ratio that measures the sensitivity of a company’s operating income to its sales.

- When return on investment is equal to than internal rate of return .

- Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

- That is, with fixed costs, the percentage changes in profits accompanying a change in volume are greater than the percentage change in volume.

- This risk arises due to the structure of fixed and variable costs.

Companies have fixed costs in their cost structure.So let us consider the example of the same firm with same data. The term leverage refers to a relationship between two interrelated variables. In a business firm, these variables may be costs, output, sales, revenue, EBIT, Earning per share etc. Thus, the operating leverage is the firm’s ability to use fixed operating leverage arises because of operating costs to magnify the effect of changes in sales on its earnings before interest and tax (EBIT). That is, with fixed costs, the percentage changes in profits accompanying a change in volume are greater than the percentage change in volume. Needless to mention here that there will be no operating leverage, if there are no fixed operating costs.

What are the benefits of operating leverage?

The DOL indicates that every 1% change in the company’s sales will change the company’s operating income by 1.38%. The challenge that this type of business structure presents is that it also means that there will be serious declines in earnings if sales fall off. This does not only impact current Cash Flow, but it may also affect future Cash Flow as well.

Funding the Fight Against Climate Change – The Dialogue – Inter-American Dialogue

Funding the Fight Against Climate Change – The Dialogue.

Posted: Mon, 31 Jul 2023 16:03:34 GMT [source]

Alternatively, the corporation might choose the latter option and fund the asset using a 50/50 per cent mix of common stock and debt. If the asset increases by 40%, the item will be worth $140,000. Operating leverage is 1.36 1, this means that 10% change in sales will cause 13.61% change in EBIT. TUV Ltd. & WXY Ltd. both are less risky as compared to market as there operating leverages and betas are more than market. We know that a low margin of safety is the product of high operating cost which reveals that the firm is unable to take the risk- bearing capacity due to sales variation. Similarly, high operating cost creates high degree of operating leverage which ultimately invites more operating risk in the field.

Learn about operating leverage formula, how to calculate operating leverage, and review an example. Operating Leverage is controlled by purchasing or outsourcing some of the company’s processes or services instead of keeping it integral to the company. Another way to control this operational expense line item is to reduce unnecessary expenses, especially during slow seasons when sales are low.

Financial Stability Review, November 2022 – European Central Bank

In contrast, a company with relatively low degrees of operating leverage has mild changes when sales revenue fluctuates. Companies with high degrees of operating leverage experience more significant changes in profit when revenues change. In good times, operating leverage can supercharge profit growth. Even a rough idea of a firm’s operating leverage can tell you a lot about a company’s prospects. In this article, we’ll give you a detailed guide to understanding operating leverage. If contribution exceeds fixed cost, operating leverage will be favourable and vice versa.

Form 497K MUTUAL FUND SERIES TRUST – StreetInsider.com

Form 497K MUTUAL FUND SERIES TRUST.

Posted: Thu, 03 Aug 2023 19:52:22 GMT [source]

The best way to explain operating leverage is by way of examples. The bulk of this company’s cost structure is fixed and limited to upfront development and marketing costs. Whether it sells one copy or 10 million copies of its latest Windows software, Microsoft’s costs remain basically unchanged. So, once the company has sold enough copies to cover its fixed costs, every additional dollar of sales revenue drops into the bottom line. In other words, Microsoft possesses remarkably high operating leverage.

Breaking Down Degree of Operating Leverage

The high leverage involved in counting on sales to repay fixed costs can put companies and their shareholders at risk. High operating leverage during a downturn can be an Achilles heel, putting pressure on profit margins and making a contraction in earnings unavoidable. Indeed, companies such as Inktomi, with high operating leverage, typically have larger volatility in their operating earnings and share prices. As a result, investors need to treat these companies with caution. Higher fixed costs lead to higher degrees of operating leverage; a higher degree of operating leverage creates added sensitivity to changes in revenue.

A high degree of financial leverage indicates high fixed financial cost and high financial risk. However, if the company’s expected sales are 240 units, then the change from this level would have a DOL of 3.27 times. This example indicates that the company will have different DOL values at different levels of operations. This variation of one time or six-time (the above example) is known as degree of operating leverage (DOL). Although you need to be careful when looking at operating leverage, it can tell you a lot about a company and its future profitability, and the level of risk it offers to investors. While operating leverage doesn’t tell the whole story, it certainly can help.

But they should only be discarded after careful consideration of the competitive situations that could arise over the long term. Operating leverage is applied for ascertaining profit planning although the CVP analysis or Break-Even analysis is used for the same purpose. It is interesting to note that the reciprocal margin of safety is expressed by operating leverage whereas Break-even analysis reveals the loss of profit at different levels of output. In other words, every additional product sold costs the business money. Companies facing this will need to raise prices or work to reduce variable costs to bring operating leverage above 1.

This might happen when the asset’s value declines or even interest rates attain unacceptable levels. In most circumstances, the financing provider will limit the risk it is willing to assume and the amount of leverage it will accept. Asset-backed lending involves the financial provider using the borrower’s assets as a security deposit until the loan is repaid. In the event of a working capital loan, the company’s overall creditworthiness is utilised to secure the loan.

Operating Leverage and Financial Leverage

Operating leverage & financial leverage could either go up or go down with debts depending on the size of the debt elasticity of real capital & contribution margin. Moreover, financial leverage varies due to the adjustment in the underlying interest payments. From the following data of Tanishka Ltd., compute the percentage change in earnings per share , if sales are expected to increase by 5%.

As QPR Ltd. has higher financial leverage hence it has high financial risk as compared to ABC Ltd. It may be mentioned here that operating leverage may be favourable or unfavourable. In other words, favourable operating leverage arises when contribution (Sales-Variable Cost) exceeds fixed cost and vice-versa in the opposite case.