This can help you track trends or seasonality and see how your business revenue is increasing or decreasing over time. You can also use past revenue numbers to help you predict the revenue you will make in the future. If you use Mobile Tech RX, you can create estimates and invoices that will be saved in your app and Admin Portal. To find past invoices, go to the ‘Documents’ tab in your Admin Portal and click ‘Invoices’.

Your shop’s parts matrix is what helps you markup parts in a fair way, and in turn, earn the appropriate profit on each part you sell. A streamlined parts ordering and documentation process starts with your service writers. If they input the wrong information in Tekmetric or forget to do so at all, it’ll have a trickle-down effect. You’ll end up scratching your head when things don’t line up in QuickBooks and the Parts Purchased Report and Parts Usage Report in Tekmetric.

What is Auto Shop Management Software?

This article is to help you manage your finances and use Quickbooks for auto repair shops, auto reconditioning shops, and auto detailing shops. A shop management system like Tekmetric helps your team track your shop’s purchases and sales. But of course, all of that financial data must also line up in your auto repair shop accounting software. Isn’t it redundant to use both a shop management system and an auto repair shop accounting software? Comparable financial statements help you spot trends, which will make it easier to work with an accountant or a consultant and make better business decisions.

You’ll get automatic billing and invoicing, bank reconciliation, short-term cash flow/business snapshots, and much more with Xero. Unlike the other applications on this list, Auto Repair Invoice (ARI) is tailored exclusively to the auto repair sector. As a result, it includes auto shop-specific functionality such as spare parts inventory tracking, vehicle lookup, and license plate scanning. It also covers “conventional” accounting functions such as invoicing, payment monitoring, and financial reporting. Another benefit of auto repair software is that it can provide valuable insights into the performance of the shop.

Reason No. 1: Are You Really Tracking Cores and Returns?

Your expenses include anything you’ve spent on your business, like employee pay, tools and supplies, products, taxes, and rent. Or, there could be a smaller reason for that disconnect, namely, things like cores and warranties. If you’re not getting that money on the back-end from your vendors, that can cut into your parts profit margin. So, if your technicians’ hourly rate is $40, then you can bump it up to $45 in Tekmetric to account for that extra overhead.

You’ll also want to find software that can simplify other aspects of running an auto repair shop. Xero provides comprehensive accounting software at a low cost, making it an intriguing prospect for small auto repair firms. While it isn’t specifically built for auto shops, it can help you stay on top of the accounting basics while saving money. Furthermore, if you’re unclear whether you want to use Xero, the service offers a 30-day free trial.

How to Run a Tire Shop

This allows you to manage the profitability of the new jobs you receive in your auto repair shop. Incorrectly accounting for inventory could also artificially inflate or reduce your gross profit on parts sold. If you don’t have a system or process to ensure that all parts are accurately tracked and reconciled to a repair order, there is no stopping employees from walking off with parts, side-work, or freebies. In many cases, when it comes to the auto care business, it may be possible to source similar products of equally high quality from another supplier. But in order to make these kinds of decisions, you need to have business financials accessible at the right time.

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. At Kaizen, QuickBooks Online (QBO) is our preferred accounting platform for our clients. When it comes to your shop’s finances, little things like a misplaced decimal point or omission can have big consequences on your bottom line. Mistakes like these can also be compounded when you use the wrong accounting methods throughout the year—comparing apples to oranges as opposed to apples to apples. Our ancestors probably made it through their winters by keeping track of the number of days they slept, the number of steps they took, and the number of berries they gathered.

Auto Repair Cloud (Free – $74.99 Per Month)

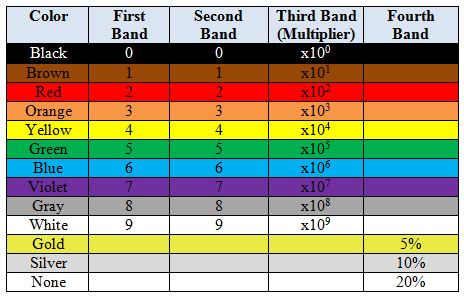

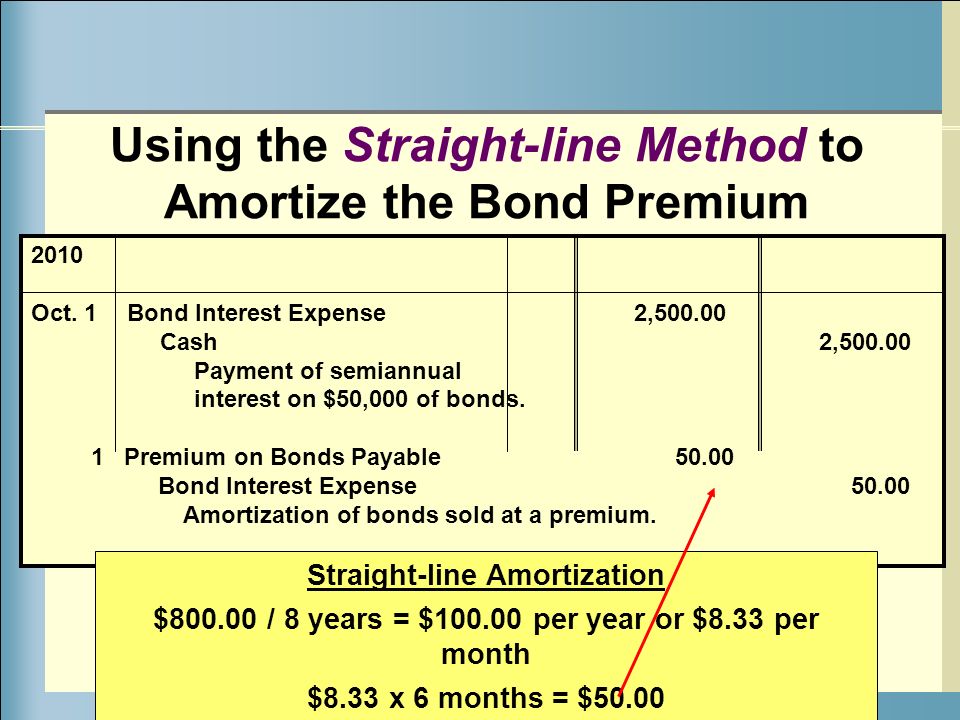

Earlier, we discussed how it’s good practice to check all your numbers at least once a month, and also thoroughly reconcile and analyze your books at least once a business quarter. Minimizing loss is what Tekmetric’s two parts reports—the Parts Purchased Report and Parts Usage Report—do best. When you use these reports alongside each other, you can compare the parts your shop has purchased with the parts your shop has actually used. Matrix pricing is a system that uses multipliers to determine the selling price of a part used in a repair order.

Once you know what you’ve brought in (revenue) and how much you’ve spent (expenses), you’ll want to calculate your profits. Once you figure out the cause, you can take the necessary steps to ensure it never happens again. So, as a starting point, make sure your service advisors assign a cost to each technician within Tekmetric and assign each job to a technician. If you don’t adjust the markup for the particular part you got for less, you’ll be losing money. But, if you get that part for $80 the next time, you might consider bumping up the markup to 20%. However, be sure to follow that win by tweaking your shop’s parts markup matrix.

Each vendor will have its own process, and once it’s ready for return, you’ll need a system in place for getting them back to the vendor. We can track everything against vendor bills or credits, the hard copies and google form at the end of the month. This is a fantastic industry to focus on – none of the shop owners I know want anything to do with the books, and there are plenty of them that can use our help. I think there are a few key areas where I accounting professionals can take on that coveted advisory role, and we’ll go over them here. CSI Accounting & Payroll offers a small portfolio of specialized services that we believe are critical to the success of automotive repair shops. AutoLeap is the ideal car repair shop cloud-based software, providing businesses with all the data they need to create a fantastic client experience while also increasing staff efficiency.

Best Car Rental Software of 2023 – Investopedia

Best Car Rental Software of 2023.

Posted: Mon, 04 Jan 2021 16:46:27 GMT [source]

To see how Mobile Tech RX can help you manage and grow your auto recon business, start your free trial now. In Quickbooks, you can automatically split your expenses into the right tax categories so that you keep more of what you earn. If needed, you can also Bookkeeping for auto repair shops easily download and share the documents with your accountant so that they can prepare your tax return for you, when the time comes. Pulling your invoices and reviewing them helps you see how much revenue you’ve generated every month, quarter, and year.

Proper bookkeeping can help you make informed business decisions, improve cash flow, and prepare for tax season. FreshBooks focuses on providing software for time tracking, reporting, invoicing, and other accounting tasks to service-based businesses — and auto repair shops certainly fit that bill. With FreshBooks, you’ll be able to easily keep track of accounting even if you have little to no experience with other accounting programs. Best of all, you can see if FreshBooks works for your business without making a commitment, thanks to its free trial.

Shop owners should ensure that all parts and supplies that will be attached to a vehicle are added to a repair order. If the purchases exceed the items attached to repair orders, you may have a theft or waste issue. These fines can destroy a business if they go unchecked because they add up quickly.

- Whatever accounting software you choose, your auto shop will benefit from simpler bookkeeping that allows you to focus on what matters in your garage.

- Today’s customers expect payment flexibility, meaning they want to pay using whatever method is most convenient for them.

- It includes your shop’s Average RO in Sales and Profits, your Profit Margin, your Gross Sales, and your Gross Profit.

- Until then, your bookkeeping system can use the final payment figure from customers.

- Moreover, using this software, you may track your receivables, employees, customers, shops, inventory, technicians, and components markup.

Plus, accepting payment online is secure and elevates your auto repair brand in the ranks of the tech-savvy. With more than 15 years serving Jacksonville, Florida, and beyond, Golden Apple Agency gives auto repair shop owners the confidence they need to operate a profitable business doing what they love. Small business owners have saved hundreds and even thousands of dollars thanks to our bookkeeping, accounting, and tax preparation services.