Creditors often charge interest on the loans they offer their clients, such as a 5% interest rate on a $5,000 loan. The interest represents the borrower’s cost of the loan and the creditor’s degree of risk that the borrower may not repay the loan. 831 (D. Minn. 1990) (mere release of hazardous substance prior to confirmation of plan does not give rise to a CERCLA claim which is discharged by confirmation). When a company goes into liquidation, the liquidator tries to settle as many debts as possible. In accounting, money that a company owes are liabilities in a balance sheet. If the company had to sign a promissory note for the quantity it owes, it would record and report the amount as Notes Payable.

On secured loans, creditors can repossess collateral like homes or cars and creditors can sue debtors for repayment of unsecured loans. The Fair Debt Collection Practices Act (FDCPA) established ethical guidelines for the collection of consumer debts by creditors. Typically, the creditors of a business are its suppliers, which have provided it with goods and services, and in exchange expect to be paid by an agreed-upon date. Or, the business owes money to a lender, which also expects to be repaid at a later date.

Personal creditors

Debtors typically have certain financial responsibilities, such as repaying the creditor according to the terms stated in the loan agreement. A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. The first party is called the creditor, which is the lender of property, service, or money. Secured creditors usually take the form of financial institutions, and their assets are anything the secured creditor wishes to have as collateral in case the debtor cannot repay the money. This type of transaction is sometimes called ‘asset-based lending’.

This differs from funding methods in which there is no expectation of repayment. They can also be card issuers such as Mastercard or Visa who lend credit to their customers which must be repaid with interest at the end of the month. While creditors lend money and are owed that money, a debt collector does not lend money. A creditor is the original lender because they made the loan to you. Debt collectors purchase delinquent loans from the original creditor, such as a bank, usually at a discount, and aim to then collect on that loan. If you owe somebody money, that person is a creditor, and you are a debtor.

Chime loan review: Instant loans and early paycheck access

The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Usually friends or family, a personal creditor lends money on a less official basis than other creditor types. Often, the creditor and debtor will work out repayment terms together, with or without interest, on a schedule suited to the debtor.

At first glance, you may be inclined to think of a creditor as only a bank or credit card company, but a creditor can be anyone that you owe an outstanding balance to. For example, John may owe Bank ABC $10,000 dollars but has not been able to pay it back. Rather than continuously attempting to collect on this loan, Bank ABC sells the loan to Debt Collector XYZ for $6,000. This way the bank has recouped some of its losses and can focus on its core business of lending, not chasing down delinquent loans.

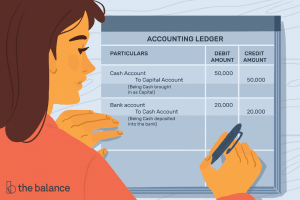

The term comes from the word ‘credit,’ which in the financial and business world means the lending of money, a good or service. If the creditor is a vendor or supplier that did not require the company to sign a promissory note, the amount owed is likely to to be reported as Accounts Payable or Accrued Liabilities. In either case, take your time to review the terms of the credit relationship to determine if it’s the right money move for you. If you’re planning to borrow money, it’s important to build and maintain a good credit score and also monitor your credit regularly to maximize your chances of getting approved for affordable financing.

Lenders without collateral, unsecured creditors have none of the debtor’s assets to seize if the debt cannot be paid. They retaliate when the debtor defaults on their payments by affecting the debtor’s credit rating and increasing interest on future loans. An unsecured creditor, such as a credit card company, is a creditor where the borrower has not agreed to give normal balance the creditor any property such as a car or home as collateral to secure a debt. These creditors may sue these debtors in court over unpaid unsecured debts and courts may order the debtor to pay, garnish wages, or take other actions. Tax debts and child support typically rank highest along with criminal fines, and overpayments of federal benefits for repayment.

What Information Do Creditors Report to Credit Bureaus?

These creditors don’t have first dibs on recouping their losses if a company goes under. If the company goes bankrupt, the shareholders won’t get their money back unless the company first pays back the bondholders and bank lenders. Any party that lends money to another party may be considered a creditor.

- For example, if Jay loans Reva $100, Reva is the debtor and Jay is the creditor.

- But they can also be individuals, nonprofit organizations, trade vendors or other entities.

- Revenue is the total income generated by a business through sales of products or services.

- In addition to the principal amount borrowed, debtors may also be required to pay interest on their principal balance.

- New customers need to sign up, get approved, and link their bank account.

In accounting presentation, creditors are to be broken down into ‘amounts falling due within one year’ or ‘amounts falling due after more than one year’… Keep track of money your company is owed with online invoicing software. Qonto collects and processes your personal data to better respond to your requests.Learn more about how we manage your data and your rights. If there was no promissory note, however, it will report it as Accounts Payable. CreditWise Alerts are based on changes to your TransUnion and Experian® credit reports and information we find on the dark web.

What is a Creditor?

Think of the example of a credit card with a credit limit of $5,000. Your credit card company makes $5,000 available to you to use if you want. You don’t have to use it all or pay it all back by a particular date — Instead, you can use what you wish of the funds over and over again as long as pay it back regularly. Real creditors will usually have the most clearly laid out terms of repayment and will hold the debtors accountable for failing to meet these repayments, either through fines or bad credit ratings.

- A sales tax is a fee customers pay at the point of sale when buying products and sometimes services.

- The creditor has provided goods, services, or money to another party.

- Debtors can be individuals, small businesses, large companies or other entities.

- Other terms for this role include borrower, debt holder, lessee, mortgagor and customer.

Banks, mortgage lenders, car dealers or even family members or friends could act as creditors. Some people may choose a different route for borrowing money—like asking someone they know for a loan. If an individual lends money to a friend or family member, they may be called a personal creditor. The term creditor is frequently used in the financial world, especially in reference to short-term loans, long-term bonds, and mortgage loans.

Rights

Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. A sales tax is a fee customers pay at the point of sale when buying products and sometimes services. As you start to build or rebuild your credit, you can monitor it with a tool like CreditWise from Capital One. It’s free for everyone, and using it won’t impact your credit scores.

Factbox: Which creditors will have priority for Citgo share auction? – Reuters

Factbox: Which creditors will have priority for Citgo share auction?.

Posted: Thu, 27 Jul 2023 20:34:00 GMT [source]

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. To ensure that your business doesn’t encounter cash flow issues as a result of the non-payment of debts, it’s imperative to manage your debtors effectively. When we use “debtor” and “creditor” in these contexts, it does not mean that the “debtor” is overdue on their bills. It also does not mean that the “creditor” is doing anything special to collect the borrowed money from the debtor.

When people talk about creditors, they typically mean financial institutions like banks or credit card issuers. This type of creditor often uses some type of approval process to determine a borrower’s eligibility for their financial products. They may enter into legally binding contracts with the party that’s borrowing money. These agreements may contain loan terms and conditions, such as repayment timelines, APR fees and more. In most cases, a creditor is a financial institution that gives money to customers in the form of loans and credit cards with the expectation that the borrower will pay back the amount.

Circularity Scotland’s unsecured creditors to receive ‘nominal sum’ – letsrecycle.com

Circularity Scotland’s unsecured creditors to receive ‘nominal sum’.

Posted: Tue, 01 Aug 2023 08:12:36 GMT [source]

Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. Creditors can make money in other ways as well, including the fees they charge to customers when they borrow money or the late payment fees they charge when customers don’t pay their bills on time. Creditors may also be classed according to whether they are “in possession” of the collateral, and by whether the debt was created as a purchase money security interest. A creditor may generally ask a court to set aside a fraudulent conveyance designed to move the debtor’s property or funds out of their reach.