However, creative professionals have particular financial concerns unique to their profession, such as music royalty accounting and managing a touring production. If you are an entertainment attorney, agent or manager, and are seeking a CPA who can provide your clients with tax and accounting services, either through you or directly servicing your client, please email or call and ask for Jerry Catalano. We provide litigation support for the music industry, including expert witness services, reviews of recoupable expenses, penny letters, tour budgets, depreciation schedules, and tax planning. The firm does tax prep and planning for artists like The Who, the Arctic Monkeys, Lizzo, Billie Eilish, Leon Bridges, Maggie Rogers and many others, but tax prep is only the beginning of their services.

- Wherever you are in the UK or around the world, it provides fast access to your financial records and allows you to keep track of ongoing expenses from your laptop or smartphone.

- UCLA is a public research university located in the Westwood neighborhood of Los Angeles, California.

- “The state of Minnesota has a specific entertainer tax, while Wisconsin has on their own tax regulations for entertainers that are from out of state,” explained Johnson.

- Accountants generally work during standard business hours, although odd hours and travel may be involved if a client lives and works in a different time zone, or if meetings must be planned around a difficult performance schedule.

- Music Business Accountants are paid per project, based on the complexity and time involved.

The Music CPA offers full service accounting, tax preparation, tax compliance and consulting services to recording artists, musicians and bands, recording labels and other music industry businesses. We are accountants, who are also musicians, helping entertainers with entertainment industry tax and accounting issues nationwide. As big music fans ourselves, we enjoy working with industry professionals and business owners to preserve wealth and maximize financial success. We offer our accounting, tax, and wealth advisory Music industry accounting services to producers, record labels, engineers, recording studios, bands, musicians, singers, dancers, choreographers, music production companies, media companies, and publishing companies. Yes, musicians and music industry professionals should consider using accounting software to manage their finances and keep better track of their income and expenses. Accounting software can help make it easier to manage finances and also provide valuable insights into costs, profit margins, and other important financial metrics.

Fortunately for arts and entertainment accountants, the best networking might come from attending a concert, play, or movie release. It’s this, along with the opportunity to work closely with artists and arts-related organizations, that draws most to this field. When your business is music, you need an accountant who has in-depth knowledge of the music industry.

The Benefits of Tax Planning for Musicians

The global recorded music market grew by 7.4% in 2020, the sixth consecutive year of growth, according to IFPI, the organisation that represents the recorded music industry worldwide. Figures released today in IFPI’s Global Music Report show total revenues for 2020 were US$21.6 billion. Alexis Kimbrough is an accountant and handles bookkeeping and taxes, and when you get financial statements each month, you can be sure they were reviewed by her first. When she’s not talking with clients, blogging, stalking you on social media, or spreading the word about Growth Group, she’s probably repairing an iPhone, watching Shark Tank, walking her lab “DC”, or attending a concert. Artistic business financial services are essential regardless of the size of the business. Therefore, Growth Group can assist any musician, photographer, designer, contractor, MLM or IBO, consultant,, self-employed, or home based business owner to make a profit and reduce taxes at an affordable price.

We speak on a variety of music industry topics including inventory management, retail store management, succession planning, and more. Entertainment industry accountants can help you create profit and loss statements, cash flow analysis, and balance sheets. They can show you key metrics based on benchmarking and help you evaluate and monitor your revenue and cash flow.

Music industry tax advice

However, since this field is so specialized, the aspiring Accountant doesn’t have to land a job with a professional music industry accounting firm right out of school to get the experience required. Music industry experience is great, but solid work history in the accounting field is more important. Other examples include print music royalties, synchronization royalties, and producer royalties. An accountant who does music business accounting needs to be familiar with the pay structure of different types of royalties to ensure that the client is getting the money they deserve and that the client is accurately paying their taxes.

Fortunately, our tax planning service for musicians is designed to smooth the bumps between months and years, taking advantage of tax breaks for creatives to spread your tax bill. We work with the entertainers directly or with their agents, attorneys and personal managers. Our focus is on tax and accounting issues, recoupable expenses, tour budgeting, asset depreciation, contracts, program budgeting and much more. When his clients head overseas on tour, Templeman leans on his Fisher School experience to make sure their international taxes are handled correctly.

What Music Business Accounting Services Encompass

UCLA is a public research university located in the Westwood neighborhood of Los Angeles, California. It was founded in 1919 and is the second oldest of the ten campuses affiliated with the University of California system. UCLA offers over 300 undergraduate and graduate degree programs in a wide range of disciplines and enrolls about 26,000 undergraduate and about 12,000 graduate students from the United States and around the world every year. Depending on the form of task you’re seeking to samlelån, a number of the finance alternatives can be more desirable than others. For example, a brief overdraft might also additionally assist you cope with a transient cash flow issue, however it could now no longer stretch sufficient in case you are embarking on a pricey tour. Likewise, crowdfunding may fit properly when you have robust guidance out of your developing audience, however neighborhood presents or artist subsidies can be higher desirable in case you are simply taking off.

We also handle accounting for musicians in bands, helping them stay on top of the income from recording, performing and touring, and on top of their tax bills. As specialist accountants for musicians, Alchemy provides tax services and advice to individual musicians, whether they’re session singers, talented songwriters or instrumentalists for-hire. His ideal job was at Bill Graham Presents, where Graham started his company as a concert promoter.

Arts and Entertainment Accountant

Acumatica is a cloud-based accounting software that provides financial management, inventory management, and order management features. It is aimed at businesses of all sizes and includes integrations with various other business tools. Sage Intacct is a cloud-based accounting software that provides financial management, inventory management, and order management features. Catalano recommends that artists be extremely wary of what music accountants call a “360 deal,” or a contract that gives most of the sales revenue to their record label, even once they have stopped performing. The Music CPA tries to save people from this dishonest policy by connecting young artists with attorneys who can review their contracts and point out any red flags. This is what Catalano describes as a fight with industry “whores and thieves,” between artists ready to sign anything to achieve their dreams and labels that don’t hesitate to take advantage of their enthusiasm.

Some cloud-based programs even offer real-time synchronization with multiple devices such as phones and tablets so that you can access your data wherever you are. Yes, QuickBooks is a very helpful tool for musicians and music industry professionals to use. It offers features such as tracking expenses and income, managing invoices, budgeting and forecasting, and connecting with payroll services to help streamline the financial side of their business. Additionally, its user-friendly interface and built-in reporting features make it easy to use. The idea is to help the client with tax planning, record keeping, tax prep, bookkeeping, bill paying, contract review, and budgeting.

The work and investment of record companies has helped lay the foundations for a predominantly digital industry that proved its resilience against the extraordinary circumstances of 2020. In a challenging year, record companies have worked alongside their artist partners to support them in creating and recording music and the whole sector has continued to drive innovations in the ways fans can experience music around the world. Growth Group also provides music business financial coaching and resources for emerging artists through online consultation and workshops. We’ll also help with the day-to-day minutiae of running your record label, including recording your financial transactions with suppliers and submitting tax returns. If you’re running an independent record label by yourself or in a small team, the likelihood is you’re taking on several different roles – acting as manager, agent, promoter and more. But you probably didn’t start your own label to act as its accountant, which is where we can help.

Universal Music Group generated $2.93bn in Q2 – boosted by sales … – Music Business Worldwide

Universal Music Group generated $2.93bn in Q2 – boosted by sales ….

Posted: Wed, 26 Jul 2023 07:00:00 GMT [source]

We assist with musician taxes, record keeping, accounting, coaching, and music contract review. “No matter how small they think the deal is, we tell our artists not to sign a contract unless a lawyer looks at it and, if you can’t afford it, we’ll find you one that provides services pro bono,” said Catalano. “You can’t accept something that you don’t understand, and these record labels made it mysterious enough for only an accountant to understand. So let us have a look at the royalty rate, and it can save you a great deal of suffering.” Despite these issues, Catalano indicated that the music industry is much more fair and transparent now than it was back in the 1960s. For example, legendary jazz trumpeter Chet Baker’s songs are streamed by hundreds of millions of people on Spotify, but his family told The Music CPA they barely get anything from the massive amount of money the record label receives from his work.

UCLA Music Industry 2023-24 Part-Time Lecturer in Finance & Accounting

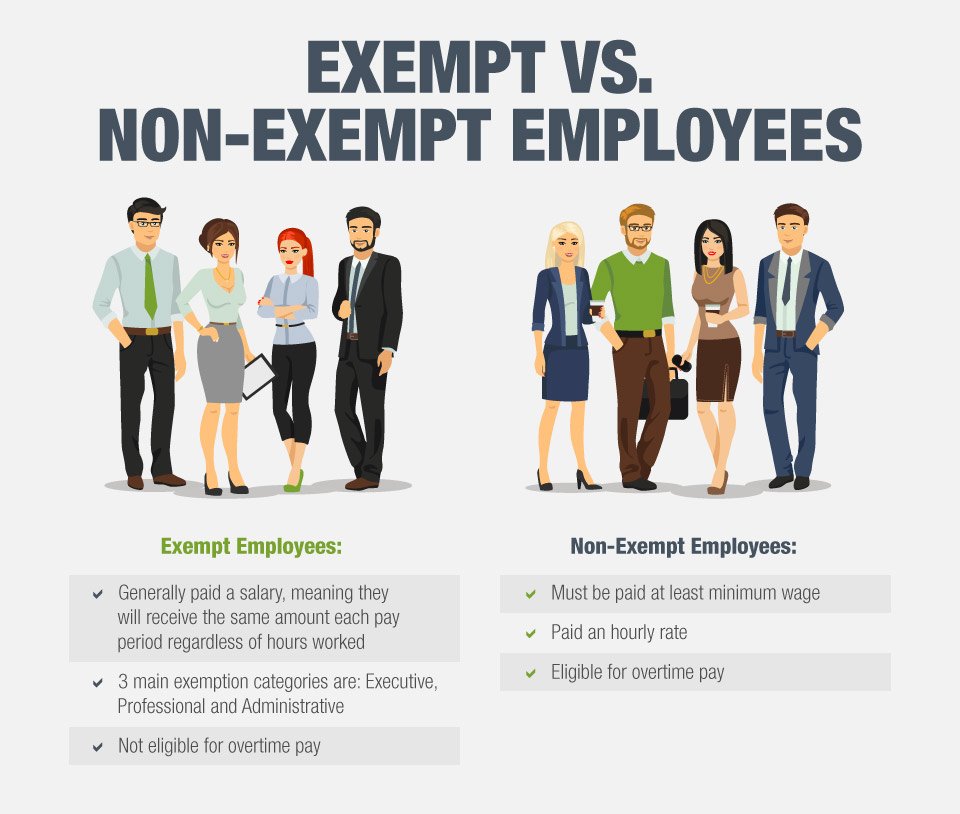

Our clients range from individuals who are part-time entertainers to seasoned industry professionals who have carved out successful careers. Their needs vary from tax return preparation to consulting or audit work related to their recording label expenses. Accountants generally work during standard business hours, although odd hours and travel may be involved if a client lives and works in a different time zone, or if meetings must be planned around a difficult performance schedule. Networking and maintaining a reputation in the industry is vital for drawing in new clients.

The 3 major music companies generated $1bn more in the first half … – Music Business Worldwide

The 3 major music companies generated $1bn more in the first half ….

Posted: Wed, 09 Aug 2023 07:00:00 GMT [source]

Total streaming (including both paid subscription and advertising-supported) grew 19.9% and reached $13.4 billion, or 62.1% of total global recorded music revenues. The growth in streaming revenues more than offset the decline in other formats’ revenues, including physical revenues which declined 4.7%; and revenues from performance rights which declined 10.1% – largely as a result of the COVID-19 pandemic. Learning never stops and Growth Group gets to know your music business, this way we can help you learn about business finances. We also keep up with current tax laws, registration and license requirements, and music and royalty accounting rules so you don’t have to! With each of these together, we’re able to provide accounting you can understand and use to make a profit in your artistic business. We work with our artists on a monthly basis to assist with managing the financial side of their artistic businesses.

With so many music platforms available, music royalty accounting software can make it easier to keep track of your royalties. “Fuelled by record companies’ ongoing investment in artists and their careers, along with innovative efforts to help artists bring music to fans in new ways, recorded music revenues grew globally for the sixth consecutive year, driven by subscription streaming. As record companies continue to expand their geographical footprint and cultural reach, music has become more globally connected today, than ever before and this growth has spread across all regions around the globe. Growth was driven by streaming, especially by paid subscription streaming revenues, which increased by 18.5%.